Personalized Credit Plan

A Roadmap Built Just for You

At Credit Sister LLC, we understand that every credit journey is different. No two credit reports — or life situations — are the same. That’s why we don’t believe in cookie-cutter solutions. With our Personalized Credit Plan, we craft a unique, step-by-step strategy tailored specifically to your credit profile, financial goals, and timeline for improvement.

Why Personalization Matters

Many credit repair companies offer the same basic process to everyone. But what works for someone trying to remove an old collection account won’t be enough for someone dealing with identity theft or rebuilding credit after a bankruptcy. Your situation requires thoughtful, targeted steps — and that’s exactly what we provide.

We don’t just look at your credit score; we dive deep into the details of your Experian, Equifax, and TransUnion reports, analyze the challenges you’re facing, and build a clear plan of action that aligns with your specific goals. Whether you’re trying to buy your first home, qualify for a business loan, or simply gain control of your financial life, your plan will be built around your needs.

What’s Included in Your Personalized Credit Plan

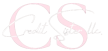

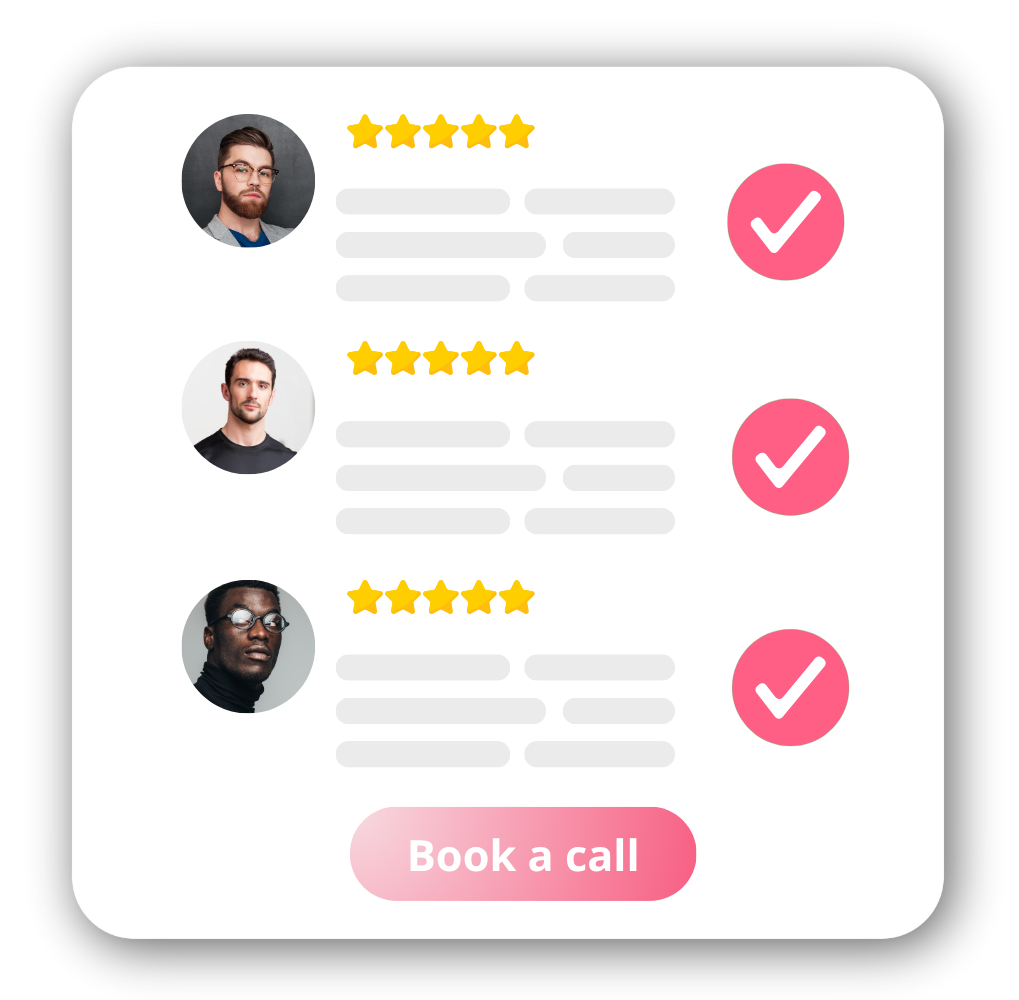

After reviewing your reports, we create a custom strategy that highlights the negative items hurting your score. You’ll know exactly which accounts we’ll dispute, what debts may be settled, and the expected timeline for results.

We also guide you in building positive credit with smart habits, new credit opportunities, and steps tailored to your financial goals. This is your step-by-step roadmap to stronger credit, built just for you.

Who Benefits from This Plan?

The Personalized Credit Plan is ideal for:

Individuals with multiple negative items across their reports

First-time credit users who want to build credit correctly

Victims of credit fraud or identity theft

People preparing for big financial moves like mortgages or car loans

Anyone feeling overwhelmed by where to begin