Dispute Inaccuracies

Clearing What Doesn’t Belong on Your Credit Report

Mistakes happen — even on your credit report. At Credit Sister LLC, we take immediate action to challenge inaccurate, outdated, or unverifiable items that are hurting your score. Our Dispute Inaccuracies service is where the real clean-up begins.

What Is a Credit Report Review?

Even a single mistake on your credit report can have serious consequences. Inaccuracies—whether it’s a falsely reported late payment, a duplicate account, or a collection you’ve already paid—can lower your credit score and affect your ability to qualify for loans, credit cards, housing, or even certain jobs. These errors can slip in due to reporting mistakes, identity theft, or outdated information that was never properly removed.

Unfortunately, most people are unaware that these items are harming their credit or that they have the legal right to dispute them. Left unchecked, these inaccuracies can cost you thousands over time and stand in the way of your financial goals. That’s why identifying and resolving them quickly is so important.

What We Do for You

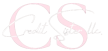

When you choose our Dispute Inaccuracies service, we take full responsibility for managing the dispute process on your behalf. We carefully draft and submit customized dispute letters to each of the major credit bureaus — Experian, Equifax, and TransUnion — addressing the specific inaccuracies found on your credit report. If necessary, we also reach out directly to creditors or collection agencies to validate or resolve the issue at the source.

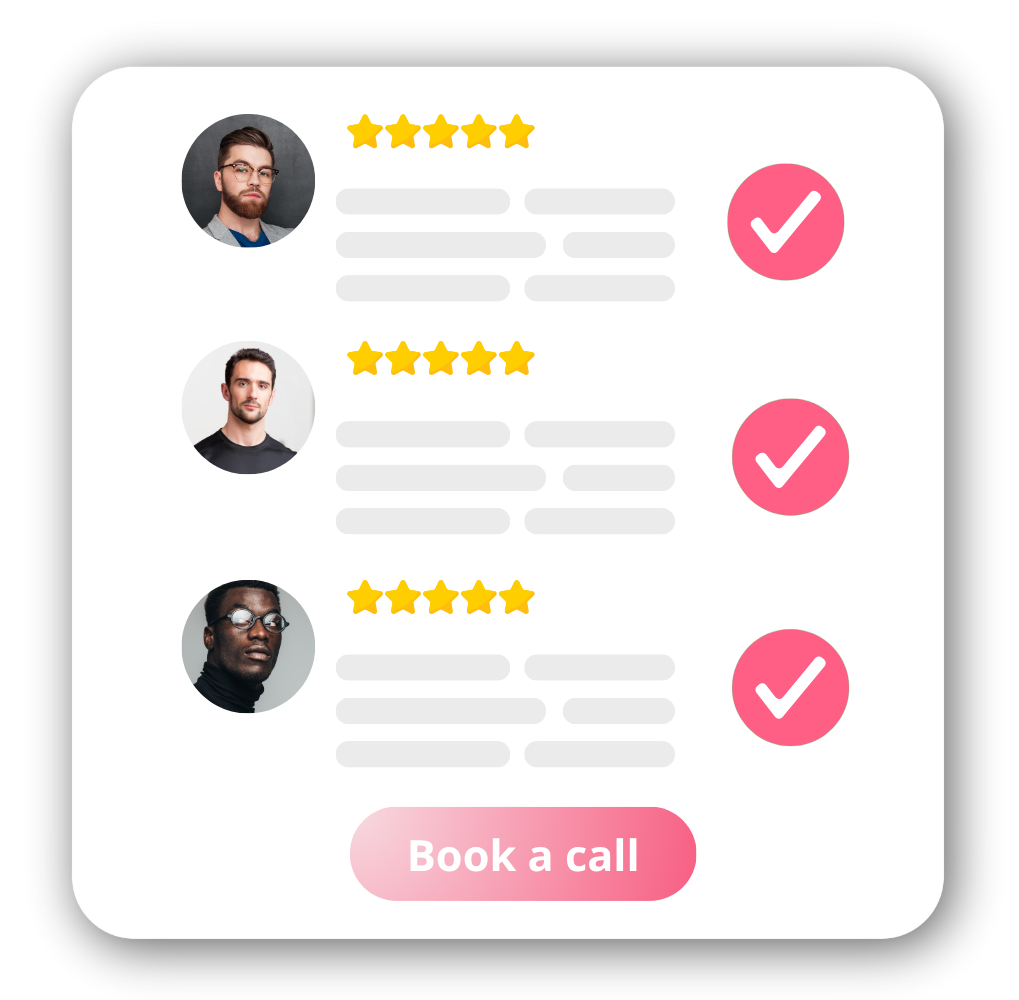

Throughout the process, we keep a close eye on all responses, track progress, and take further action if any disputes are ignored or rejected. Our team handles all the back-and-forth communications, follows up with supporting documents, and ensures your case is being properly investigated. While we work behind the scenes, you’ll receive regular updates so you always know what’s happening with your credit file.

Who Needs This Service?

Our dispute services are perfect for:

People who’ve discovered errors after reviewing their credit report

Victims of identity theft or fraud

Those who’ve paid debts still showing as unpaid

Individuals with mixed or merged credit files

Anyone denied credit for reasons they don’t understand

People tired of trying to dispute on their own — without results