Empower. Restore. Grow.

Credit Solutions Powered by Credit Sister

Enhance your service offerings by partnering with a trusted credit repair team — we handle dispute management, credit guidance, and financial education so your clients can focus on their goals.

How Our Clients Benefit with Credit Sister

Improved

Credit Score

Our Credit repair services help remove errors and negative items from your credit report. This leads to a higher credit score and better financial opportunities.

Faster Results

Than DIY

Our professionals understand credit laws and know how to communicate effectively with bureaus. This allows them to achieve faster improvements than most individuals can on their own.

Access to Better

Loan Terms

With a repaired credit profile, clients can qualify for lower interest rates and higher loan amounts. This can save them thousands over time in reduced financial costs.

Fully embedded

within your platform

Simple, Hassle-Free Onboarding

Get started quickly with a process that’s streamlined and personal. No big teams, no tech confusion—just one-on-one support from someone who knows the process inside out.

Experience You Can Trust

With hands-on expertise and a strong understanding of credit laws and disputes, I personally handle each case to ensure accuracy, compliance, and peace of mind.

Tailored to You

From communication to documentation, everything is designed to match your style and needs—offering a personalized experience that puts you first.

Our Services

Tailored Solutions to Repair Your Credit & Relieve Collection Pressure

Credit Report Review

A thorough analysis of your credit report to spot errors, outdated accounts, or inaccurate negative items. This helps you understand what’s hurting your credit score and where improvements can be made.

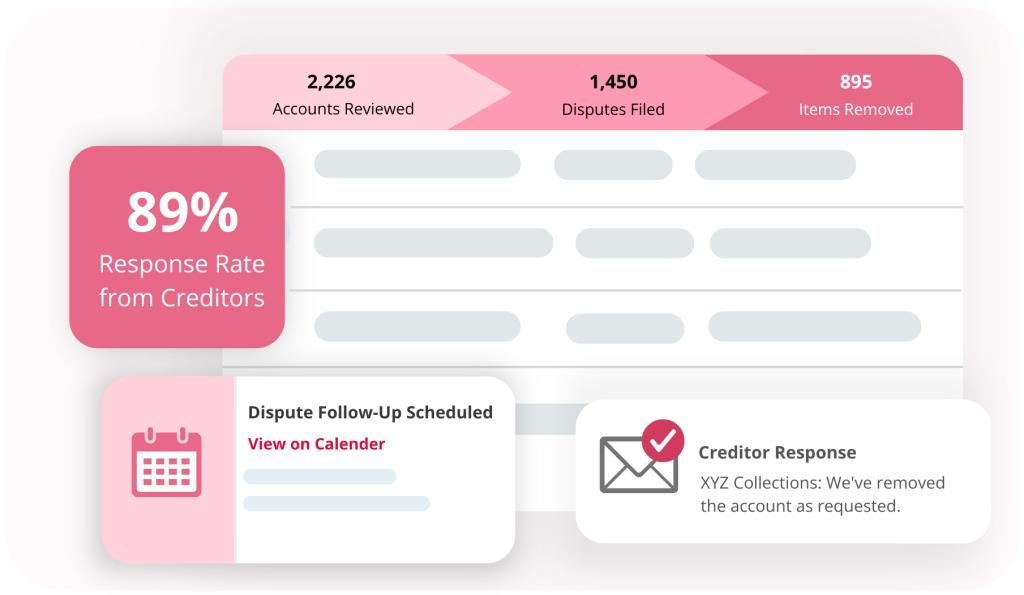

Dispute Inaccuracies

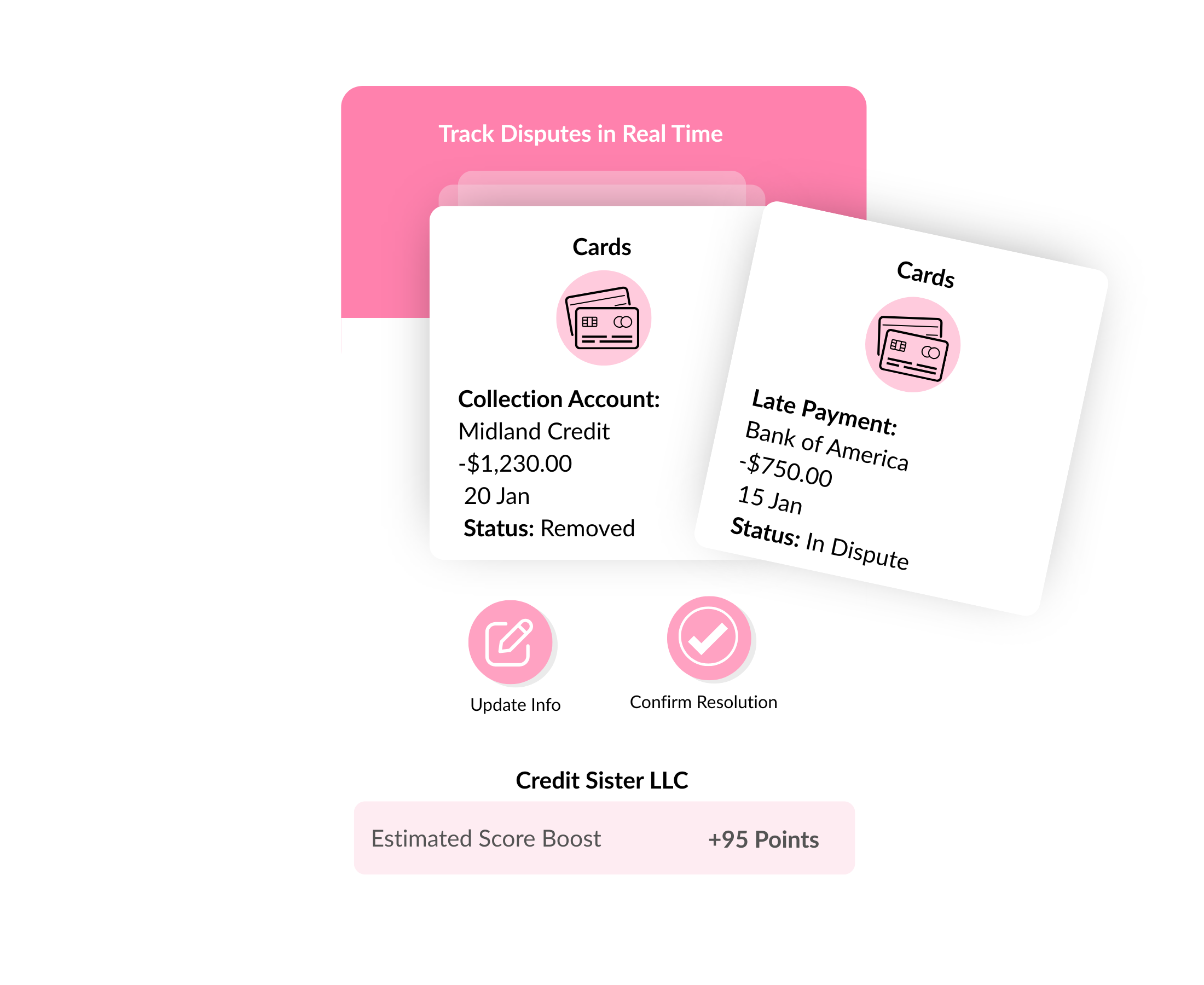

We handle the process of disputing incorrect or unverifiable items with credit bureaus on your behalf.

Personalized Credit Plan

A custom strategy tailored to your credit goals—whether it’s improving your score, reducing debt, or preparing for a major purchase.

Creditor & Collection Calls

We communicate directly with creditors and collectors to resolve disputes and negotiate where possible.

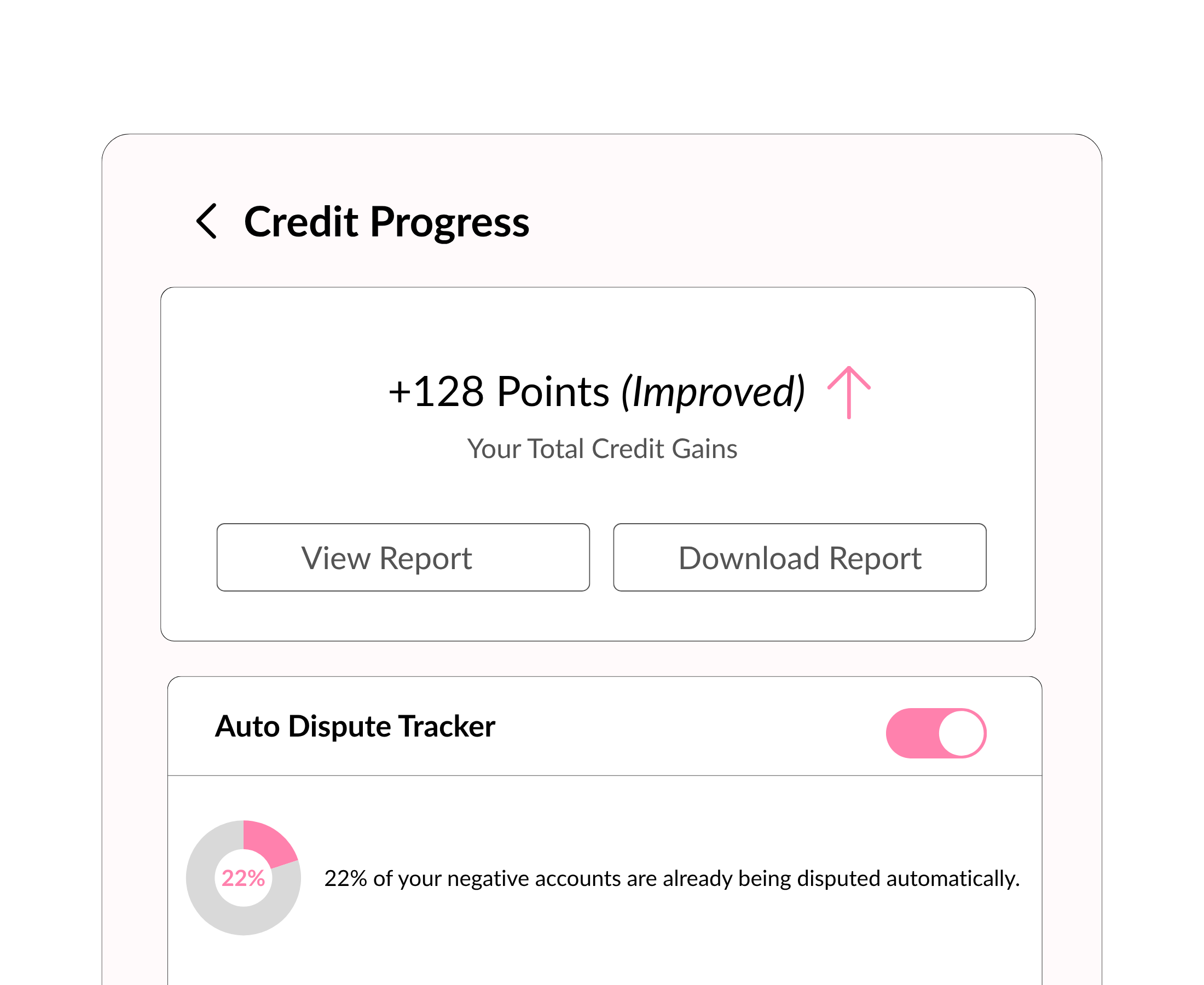

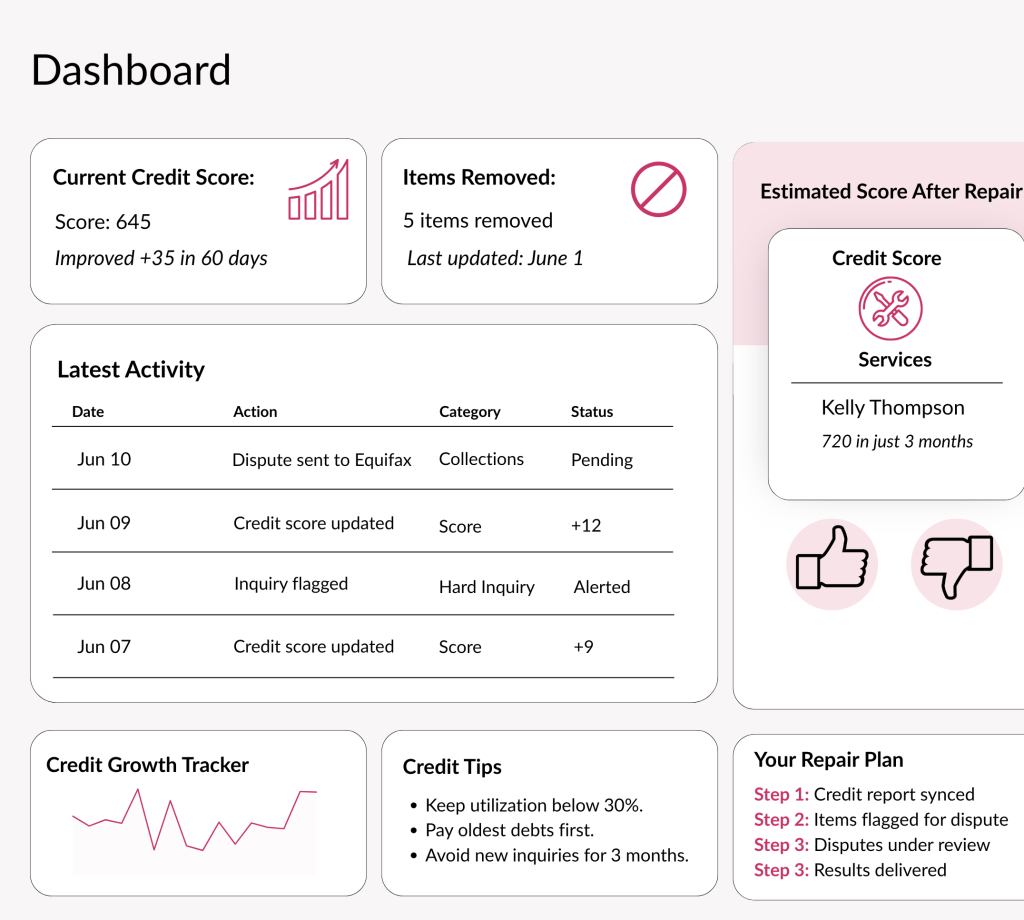

Progress Tracking & Updates

Stay informed every step of the way with real-time updates on your credit repair progress. From dispute statuses to item removals, we keep you in the loop so you always know what’s happening with your credit file.

Credit Education & Guidance

Ongoing support to help you understand your credit, avoid future issues, and make informed financial decisions.

Individuals We Support:

People with Poor or Damaged Credit

Those who’ve faced late payments, charge-offs, or collections.First-Time Credit Builders

Young adults or immigrants new to the U.S. credit system.Victims of Identity Theft

Individuals with fraudulent accounts affecting their credit report.Consumers Denied Loans or Rentals

Those rejected due to credit score issues or negative marks.Those Preparing for Major Life Goals

Buying a home, getting a car loan, or applying for business credit.

Industries & Professionals We Work With:

Real Estate & Mortgage Brokers

Helping clients qualify for better loan terms.Car Dealerships

Supporting buyers who need credit improvement to secure financing.Financial Advisors

Partnering to improve clients’ overall financial health.Legal Professionals

Working with attorneys handling bankruptcies or credit disputes.Small Business Owners

Assisting in building or repairing business credit.

Individuals We Support:

People with Poor or Damaged Credit

Those who’ve faced late payments, charge-offs, or collections.First-Time Credit Builders

Young adults or immigrants new to the U.S. credit system.Victims of Identity Theft

Individuals with fraudulent accounts affecting their credit report.Consumers Denied Loans or Rentals

Those rejected due to credit score issues or negative marks.Those Preparing for Major Life Goals

Buying a home, getting a car loan, or applying for business credit.

Industries & Professionals We Work With:

Real Estate & Mortgage Brokers

Helping clients qualify for better loan terms.Car Dealerships

Supporting buyers who need credit improvement to secure financing.Financial Advisors

Partnering to improve clients’ overall financial health.Legal Professionals

Working with attorneys handling bankruptcies or credit disputes.Small Business Owners

Assisting in building or repairing business credit.

Frequently Asked Questions

What is credit repair?

Credit repair is the process of identifying and disputing errors or negative items on your credit report to improve your credit score over time.

How long does credit repair take?

Most clients begin seeing results within 30 to 60 days, but full credit restoration can take 3 to 6 months, depending on your credit history.

Can you remove collections or late payments from my report?

Yes. We dispute inaccurate, outdated, or unverifiable collection accounts and late payments. If successfully removed, your score can improve.

Will this improve my credit score?

Yes. Removing negative items and adding positive credit behavior can increase your score, helping you qualify for better financial opportunities.

Is credit repair legal?

Absolutely. Under the Fair Credit Reporting Act (FCRA), you have the right to dispute any item on your credit report that you believe is incorrect or unfair.

What’s the cost of your services?

We offer flexible plans depending on your credit situation. Book a free consultation to get a personalized quote—no hidden fees.

Can you help if I’ve been denied a loan or apartment?

Yes! Many of our clients come to us after loan denials. We’ll help identify the credit issues causing the problem and guide you toward fixing them.

Do you offer business credit repair too?

Yes, we assist entrepreneurs and small business owners with establishing or rebuilding business credit profiles.

How do I get started?

It’s easy! Just book a free call with us. We’ll review your credit report and walk you through the next steps—no obligation.